Car Finance in 2025 - The Big Picture

If you’re thinking about buying your next car in 2025, chances are you’ve come across the term car finance. It’s one of the most popular ways to get behind the wheel of a new or used vehicle, but with the automotive industry evolving quickly, you might be wondering what’s new this year and what’s still the same.

We’ll walk you through the current car finance landscape, breaking down the updates you need to know about and giving you a clear picture of your options. Whether you’re upgrading to something more fuel-efficient, looking at an electric vehicle, or simply exploring your budget, this is a friendly overview of car finance in 2025.

Car finance has been a go to choice for UK drivers for years and in 2025 it’s just as popular. Rising car prices, increased interest in electric vehicles and flexible payment options have kept finance agreements at the heart of the car buying process.

While the basic idea remains the same, spreading the cost of your car into manageable monthly payments, there are a few notable changes this year that could influence your decision.

What’s Changed in Car Finance for 2025?

1. Higher Interest Rates - But with Signs of Stability

The last couple of years have seen interest rates rise across many types of lending, and car finance has been no exception. While rates are still higher than they were pre-2022, 2025 is showing signs of stability. Many lenders are now offering more competitive deals again, especially for those with strong credit scores.

Tip: Always compare APR rates before committing and check whether your monthly payment includes any fees or extras.

2. EV-Specific Finance Deals

With the push towards electrification, finance packages for electric vehicles have become more attractive. Some manufacturers and finance providers are offering reduced interest rates, deposit contributions, or added extras like free home charger installation when you finance an EV.

Why it matters: If you’ve been on the fence about going electric, the finance incentives in 2025 might just tip the balance in favour of making the switch.

3. More Flexible PCP and HP Options

PCP (Personal Contract Purchase) and HP (Hire Purchase) remain the most popular choices, but flexibility has improved. In 2025, some lenders are offering the option to make overpayments, shorten or extend your agreement mid-term, or even switch to a different vehicle without penalties.

Good to know: This flexibility can be a big help if your circumstances change, giving you more control over your car and your budget.

4. Increased Focus on Transparency

In recent years, there’s been a bigger push for clarity in finance agreements. In 2025, lenders are placing more emphasis on breaking down the total cost of borrowing, so you can see exactly how much you’ll pay across the agreement.

This includes clearer explanations of:

- The difference between interest rates and APR

- Balloon payments at the end of PCP deals

- Early termination fees

What Hasn’t Changed?

1. The Main Types of Car Finance

The key options remain the same:

- PCP (Personal Contract Purchase)- Low monthly payments, with the choice to buy the car at the end or hand it back.

- HP (Hire Purchase)- You own the car once all payments are made, typically with higher monthly payments but no large final payment.

- PCH (Personal Contract Hire)- A lease agreement where you hand the car back at the end with no option to buy.

These formats are still the backbone of UK car finance, so if you’ve used them before, you’ll feel right at home.

2. Credit Score Importance

Your credit history remains one of the biggest factors in determining your eligibility and interest rate. Good credit scores can open the door to lower APRs and better deals, while poor scores can mean higher costs. A great credit score can support your application, even if you can’ provide a payslip.

3. Deposit Contributions

Manufacturers and dealers are still offering deposit contributions on selected models when you take out finance. This essentially means they put money towards your deposit, reducing the amount you need to pay upfront.

How to Get the Best Car Finance Deal in 2025

1. Know Your Budget- Work out what you can afford each month without stretching yourself.

2. Check Your Credit Score- This can help you target the best available rates.

3. Compare Deals- Don’t just focus on monthly payments; check the total amount payable.

4. Consider the Type of Car- EVs might come with added finance incentives in 2025.

5. Ask Questions- Make sure you fully understand the terms before signing.

The Bottom Line

Car finance in 2025 still offers a straightforward way to spread the cost of your next vehicle, with familiar options like PCP and HP leading the way. The big differences this year are the increasing flexibility of agreements, tailored EV deals and a push for clearer, more transparent pricing.

If you’re ready to explore your options, the team at Swansway Motor Group is here to help. We’ll walk you through the choices, explain the details and make sure you drive away with a finance package that suits your lifestyle and budget.

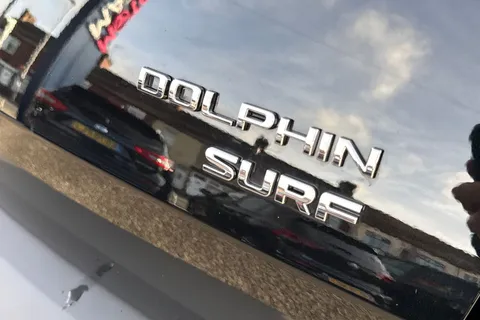

Search Our Newest Stock Today

Finance representative example

Total cash price£14,450.Borrowing£14,450with a£3,200deposit at a representative APR of0%.

- Cash Price£14,450

- Deposit£3,200

- APR0%

- Monthly Payment£94

- Rate of interest0%

- Total Payable£14,450

- Term48 months

- Total Deposit£3,200

- Deposit Contribution£2,200