Looking Back at the 2025 VED Shake Up

If you’re keeping an eye on the UK electric vehicle (EV) scene, you’ve probably noticed how the road tax (Vehicle Excise Duty, or VED) rules shifted earlier this year. Honestly, people are still talking about it, so, in this blog we’ll look into this a little further and discuss it in a bit more detail.

What Actually Changed in April 2025

Back in April this year, EVs in the UK lost their road tax exemption. Here’s a breakdown of what new and existing EV owners are now paying:

- For New EVs Registered on or After 1st April 2025 - First year VED was just £10 and the Second year onwards, they pay the Standard Rate of £195 per year.

- For EVs Registered between 1st April 2017 - 31st March 2025 - Owners now also pay the £195 standard rate when their tax renews.

- For Older EVs (Registered before April 2017) - These have been moved into lower VED band. Many are now paying around £20 per year.

- For EVs with a list price over £40,000 - The “Expensive Car Supplement” now applies. That’s an extra £425/year, making VED up to £620/year for five years.

Why it’s Becoming a Big Conversation

What Supporters are saying:

- Fairer Contribution - The government argues EV drivers should contribute more, especially now that fuel duty revenues are shrinking.

- Modernisation - As EVs become a bigger part of the vehicle fleet, taxation is being ‘equalised’ to keep the system sustainable.

- Smoother Transition - Some think this change is just part of the growing pains of switching to cleaner transport, a necessary step.

What Critics are Worried About:

- Cost Shock - There’s concern that this feels like a penalty, especially for more expensive EVs.

- Detering Buyers - The extra £425 a year supplement could put off families or buyers considering a higher spec EV.

- Future Tax Proposals - There’s talk of a ‘pay per mile’ tax for EVs being introduced in the coming years.

- Charging VAT Imbalance - Some EV drivers pay 20% VAT on public charging, while home electricity is taxed at only 5%, adding to running costs.

What this Means for You

If you’re thinking of going electric, here are a few things to consider now that the new tax regime has settled in:

- Run the Numbers - Don’t just look at the sticker price, work out your total cost of ownership, including VED, insurance, charging and maintenance.

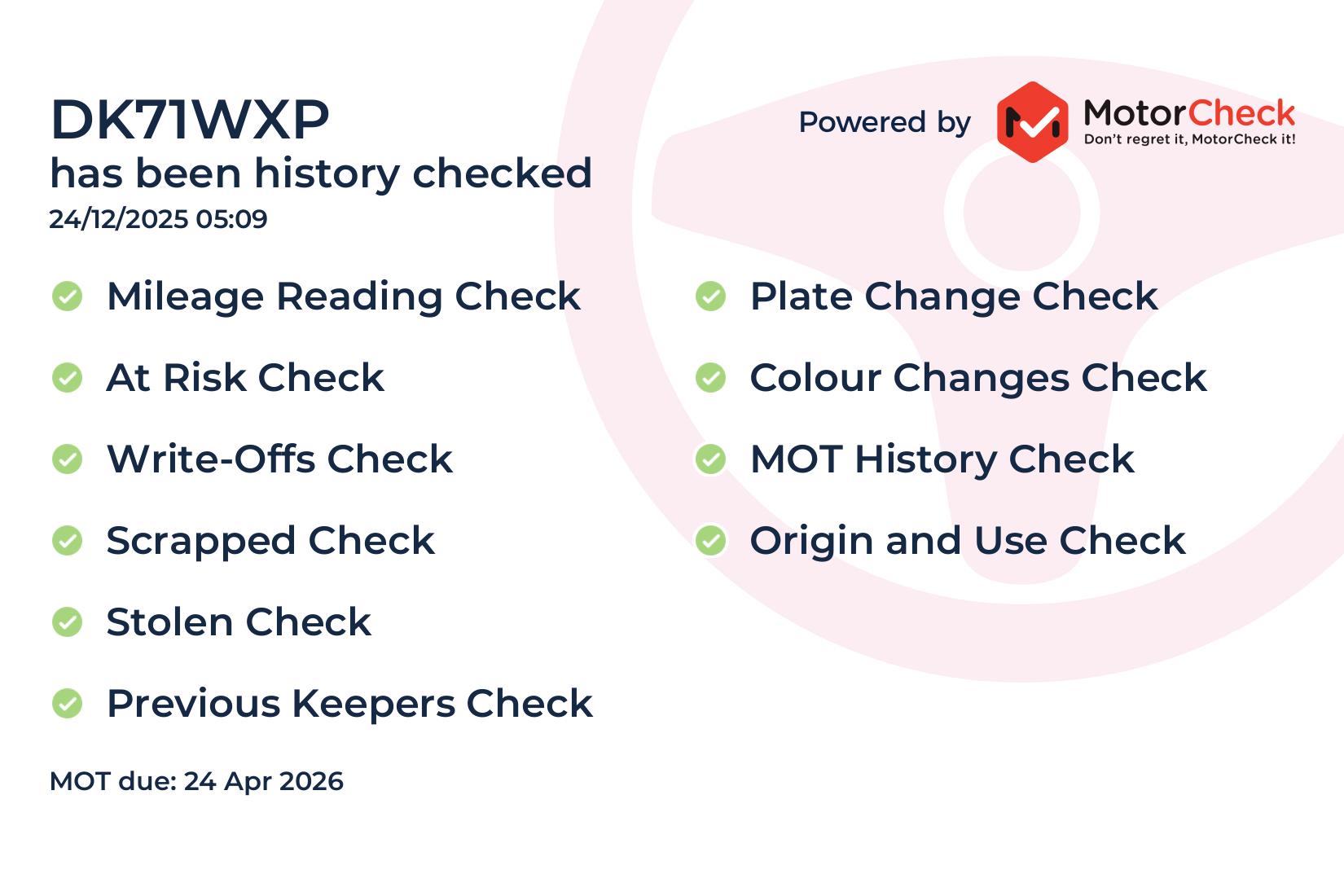

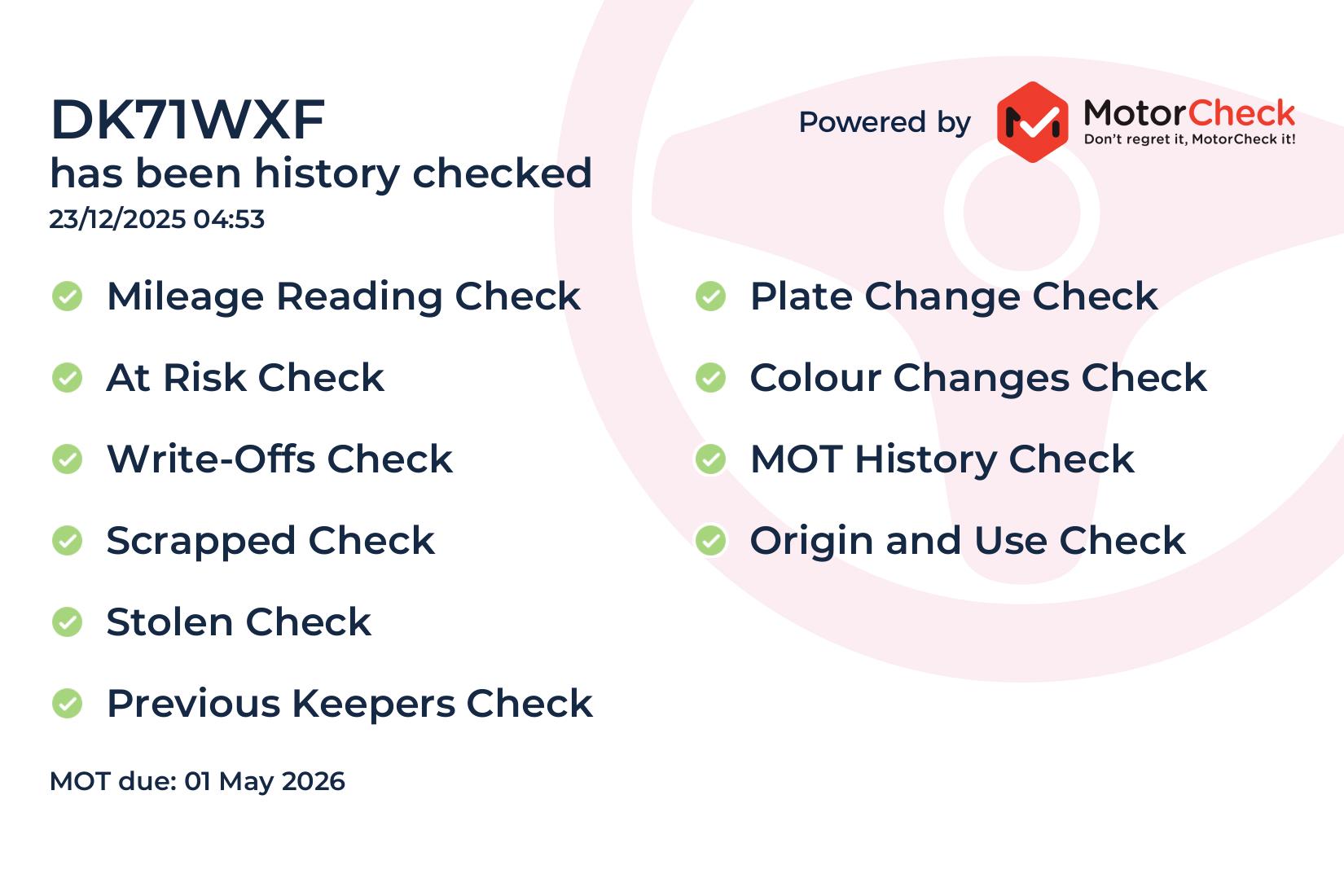

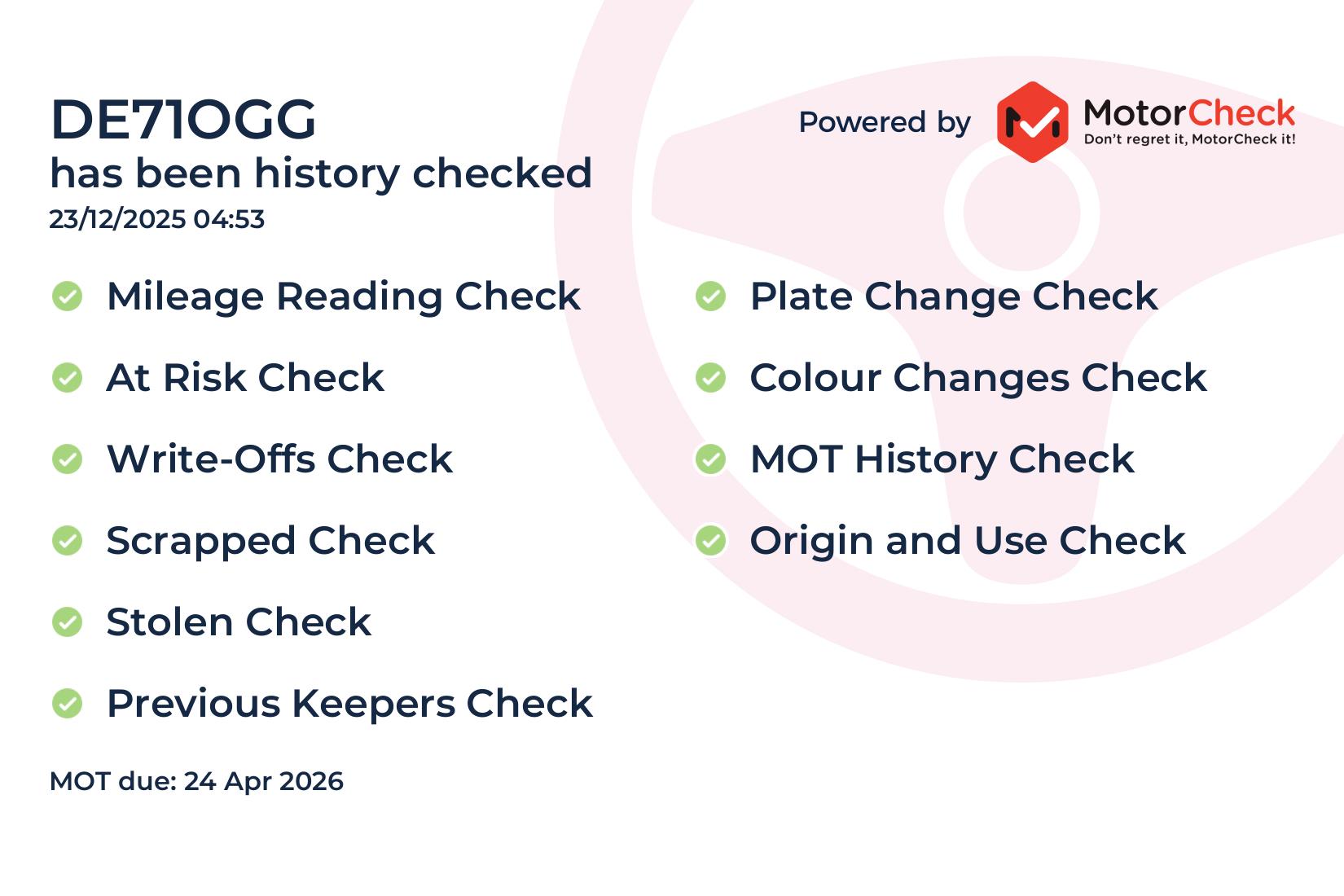

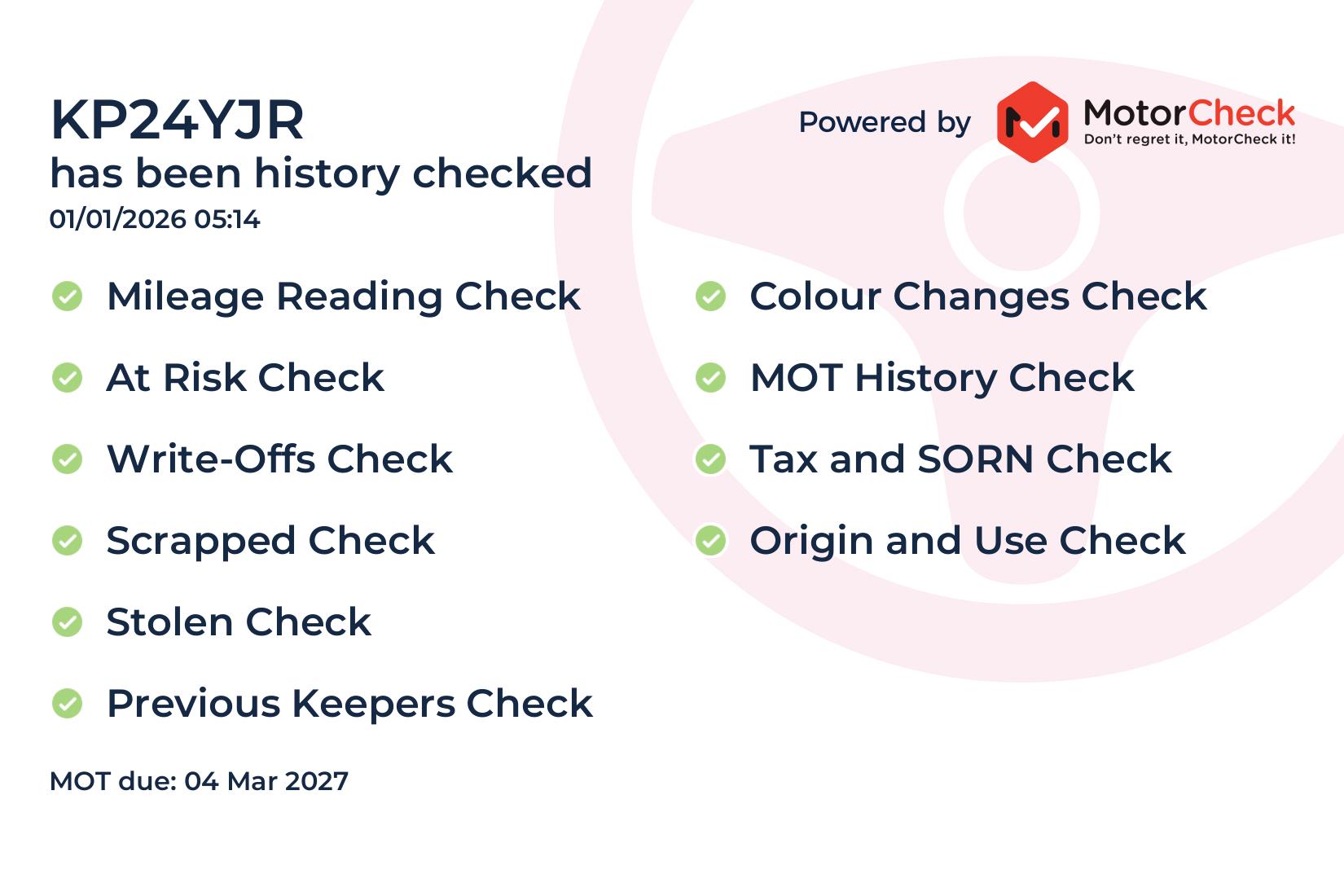

- Check the Registration Date - Because the VED rate depends heavily on when a vehicle was first registered, this will affect how much you pay.

- Consider the Price Point - If you’re looking at an EV worth over £40,000, make sure to factor in that £425/year supplement. For some, that could be make or break.

- Be Forward Looking - With discussions around mileage based tax ticking away, it’s smart to stay informed. Policies may change again as EV adoption grows.

Why Choosing Swansway or Motor Match Makes Sense

Here’s how we can support you through this debate and help make an informed decision:

- Clear Cost Projections - We’ll walk you through realistic tax and running cost scenarios based on the specific EVs you’re looking at.

- Charging Guidance - We can help you explore cost effective charging options, whether that’s installing a home charger or finding the right public network.

- Tax Advice - We stay up to date with the latest policy changes (like proposals for pay per mile tax) so you don’t have to, we’ll brief you on what might come next.

Some Final Thoughts

The April 2025 road tax shake up for EVs has stirred up a healthy debate and it’s not just about money. It’s about how we balance fairness, sustainability and real life costs of going electric. If you’re ready to explore EVs or just want help with the numbers we’re here. Drop us a message or come in for a chat at your local dealership, we’d love to help you find your perfect value!