If you’ve seen the headlines recently, you’ll know there’s been a lot of talk about a possible new “pay per mile” tax for electric vehicle (EV) drivers, set to come in from 2028. It’s caused quite a debate among motorists and the automotive industry and understandably so.

At Swansway Motor Group, we know changes like this can raise plenty of questions. So, let’s take a look at what’s actually being discussed, why it’s on the table and what it could mean for drivers over the next few years.

What’s being proposed?

The government is reportedly considering a pay per mile tax for EVs, to help recover some of the revenue lost as more drivers move away from petrol and diesel cars. Currently, fuel duty, the tax added to petrol and diesel brings in billions each year, but that’s set to fall as the number of electric cars on UK roads continues to rise.

The suggestion is that EV drivers might pay around 3p per mile, with payments potentially linked to annual mileage. Nothing has been confirmed yet and it’s likely we won’t see firm details until closer to 2028, (plenty of time to vent).

Why are people talking about it?

The proposal has had a mixed response, as many agree that in the long run, it’s fair for all drivers to contribute towards maintaining the UK’s roads, no matter what powers their car.

But others, including some leading car manufacturers, believe the timing could be off. They’ve warned that introducing a new tax while EV adoption is still growing could discourage people from making the switch, at a time when the UK is working hard to reach its net zero targets.

There’s also concern about clarity, how will mileage be tracked or reported and what about drivers who only cover short distances each year?

How might it affect drivers?

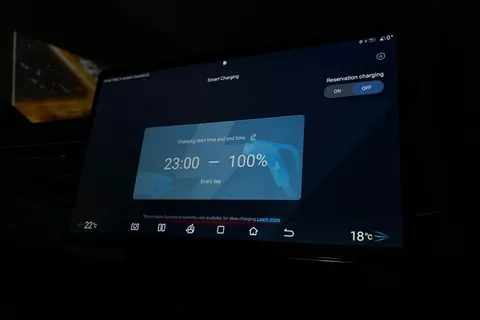

Right now, EVs remain one of the most affordable ways to get around when it comes to running costs. Charging at home is still significantly cheaper than filling up with fuel, and servicing costs are generally lower too.

If a pay per mile tax were introduced at around 3p per mile, the average UK driver covering roughly 9,000 miles a year could see an extra £270 a year added to their motoring costs. That’s still far less than the typical fuel duty paid by petrol or diesel drivers, which can exceed £600 a year, but it does narrow the gap slightly.

It’s worth remembering though, that these figures are only estimates based on early reports and nothing’s set in stone.

What this means right now

The most important thing to know is that this change isn’t happening yet and even if it does, the details could look quite different from what’s being suggested today.

For anyone considering an EV, there’s still plenty of time to take advantage of the benefits electric driving offers, from lower day to day running costs to zero tailpipe emissions and a smoother, quieter drive.

We’ll be keeping a close eye on how this develops, helping drivers understand what any changes mean for them.

Thinking about making the switch?

If you’re curious about going electric, or you’d simply like to learn more about how EV ownership works, our friendly teams are here to help. Whether you’re interested in a brand new EV or looking at a used model from our Motor Match range, we’ll help you find the right car to suit your lifestyle and your budget.

You can browse our latest electric and hybrid models or get in touch with your local Swansway dealership for a friendly chat.

We’re helping you make sense of motoring, one mile at a time.