Why Prices Are Rising and How to Save

Buying a car is an exciting moment, whether you’re treating yourself to a brand new car from Swansway, or finding the perfect used car, there’s one thing that always needs sorting alongside your new set of wheels…car insurance.

If you’ve had a quote recently, you’ll know car insurance prices in the UK are higher than ever in 2025.

So, why are premiums going up and more importantly, what can you do to keep costs down? Let’s take a look.

Why are UK car insurance prices rising in 2025?

The simple answer is insurers are facing higher costs and that’s being passed on to drivers. But here are the main reasons behind the rise:

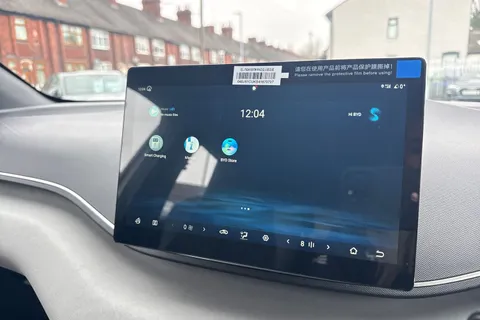

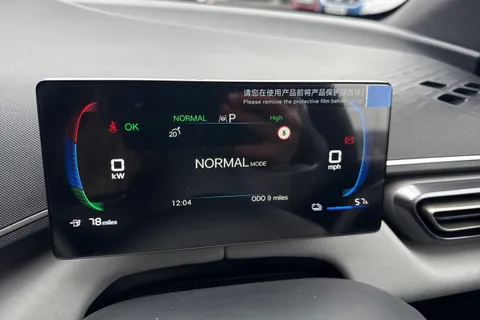

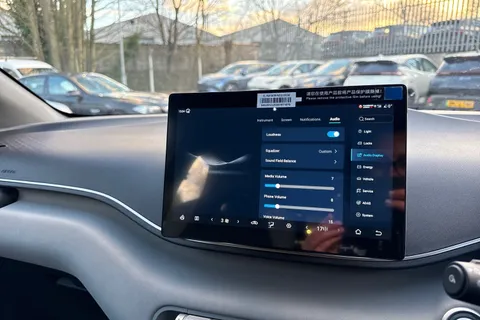

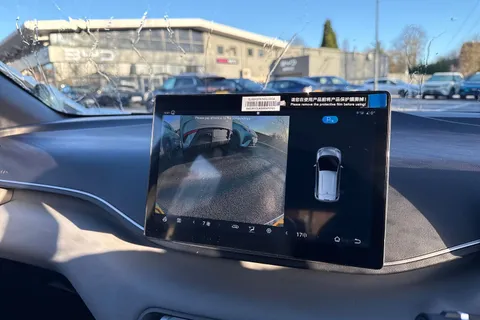

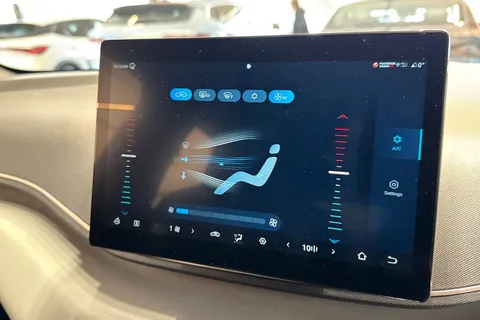

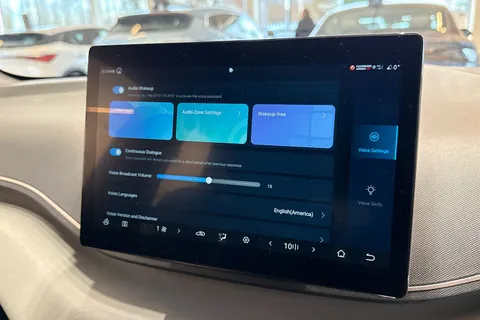

Repair costs are up - Modern cars are packed with technology and safety features. Great news for drivers, but those advanced sensors, cameras and systems can be expensive to repair or replace.

Inflation and labour costs - The rising cost of parts, plus higher wages in the repair industry, means insurance companies are paying out more.

More claims on the roads - There’s been an increase in the number of accidents reported, as well as more expensive claims being made.

Fraud and scams - Sadly, ‘crash for cash’ scams and exaggerated claims still add to the cost of premiums for everyone.

Younger drivers re-entering the market - With driving test backlogs now mostly cleared, there’s been a rise in younger, less experienced drivers on the road and that pushes average premiums up too.

How much are UK drivers paying for insurance in 2025?

On average, car insurance costs are now at their highest level in more than a decade.

Recent figures suggest many drivers are paying over £1,000 a year for cover and for younger drivers under 25, it’s not unusual to see quotes of £2,000 - £3,000 depending on the car and postcode.

This makes it even more important to understand how insurance is calculated and what you can do to cut costs.

Top tips to save money on your car insurance in 2025

Here are some practical steps you can take to help keep your premiums under control:

Shop around every year - Don’t just auto renew. Comparison sites and direct quotes often show big savings if you’re willing to switch.

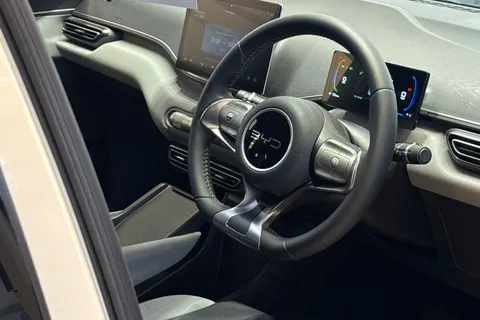

Choose the right car - Cars with smaller engines and lower insurance groups usually cost less to insure. If you’re thinking about changing your car, it’s worth checking insurance costs before you buy.

Pay annually if you can - Monthly payments might feel easier, but they usually come with added interest. Paying upfront often saves money in the long run.

Add a named driver - For younger or less experienced drivers, adding a responsible older driver (like a parent) can sometimes reduce premiums.

Build your no claims bonus - The longer you drive without making a claim, the more discount you’ll build on your insurance.

Increase your voluntary excess - Agreeing to pay a higher excess in the event of a claim can reduce your premium. Just make sure you can afford it if you do need to claim.

Consider black box insurance - Telematics policies reward safe drivers with lower premiums, which can be especially useful for younger drivers.

Avoid unnecessary add-ons - Windscreen cover, breakdown cover, or courtesy car cover can all be useful, but check if you already have them elsewhere before paying extra.

Improve your car’s security - Parking in a garage or driveway, or fitting an approved alarm or tracker, can help cut costs.

Drive less if you can - Lower mileage often means lower risk, so if you’re working from home more or don’t use your car daily, make sure your insurer knows.

What affects your car insurance premium?

Ever wondered why two people can pay very different amounts for similar cars? Here are some of the biggest factors that insurers consider:

· Your age and driving experience

· Where you live and park your car

· Your annual mileage

· Your occupation

· Your claims history and no claims bonus

The car itself including, engine size, safety rating and even the colour can play a part

Should you switch your car to save on insurance?

If you’re feeling the pinch, it might be worth looking at the type of car you drive. Cars in lower insurance groups tend to be cheaper to cover and you don’t always need to compromise on comfort or technology to make savings.

At Swansway, we’ve got a wide range of new cars from leading manufacturers that balance safety, economy and insurance costs. Whether you’re upgrading, downsizing, or simply fancy a change, we’re here to help you find the right car and maybe even lower your insurance costs in the process.

Yes, car insurance is more expensive in 2025, but with a little research and some smart decisions, you don’t have to pay over the odds.