Welcoming Omoda and Jaecoo

In recent years, the global automotive landscape has grown ever more competitive and dynamic. Among the most intriguing developments has been the emergence of new Chinese auto-brands geared explicitly for export markets. At the forefront of this wave are the sister brands Omoda and Jaecoo, both launched by the Chinese automaker Chery Automobile. These brands don’t simply reflect incremental growth, they illustrate a strategic shift - Chinese manufacturers moving from ‘follower’ to ‘challenger,’ and redefining what global buyers expect when they shop for vehicles.

Here’s a deep dive into what Omoda and Jaecoo represent, why they matter, and how they are already reshaping the automotive playing field.

Origins & Positioning

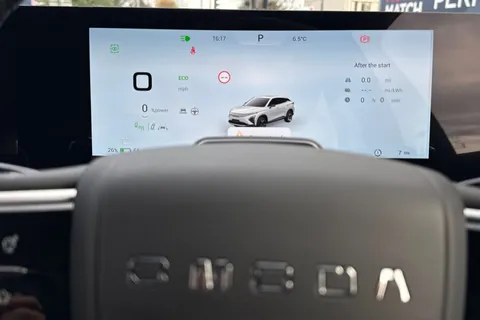

Following on from Omoda’s birth in 2022, Jaecoo was launched in April 2023, similarly by Chery, targeting overseas markets with a more premium and adventurous SUV-centric brand image. Omoda, coming before Jaecoo was established directly a year before the latter, and Omoda’s name derives from oxygen and “moda” meaning modern, reflecting a youthful and energetic identity. Most importantly, both brands are for export-only (or at least initially) so they are aimed at markets outside China. This allows Chery to tailor the image and product strategy, independent to its legacy.

Why is this significant?

Rather than just exporting existing models, Chery is creating fresh brand identities designed for international appeal. This shows a leap in ambition, from being a Chinese domestic player to a genuinely global player, shaping the narrative rather than just following it.

Key Markets & Growth Strategy

In the UK, Omoda and Jaecoo already have aggressive rollout plans, with aims for up to five new SUVs and 130 dealerships by 2026. Initially launched in the UK with the Omoda 5 and Omoda E5, the brands are undercutting established rivals, in an attempt to disrupt the mainstream mid-sized SUV market. On the production front, there are even plans for assembly, or local manufacturing in Europe.

What this tells us?

Chery is applying a two-fold strategy - one being territorial expansion via dealership networks and the second is to boost localisation to win credibility and have a cost advantage in key markets.

Design, Technology & Product Differentiation

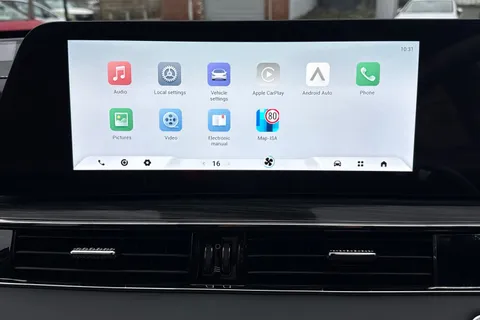

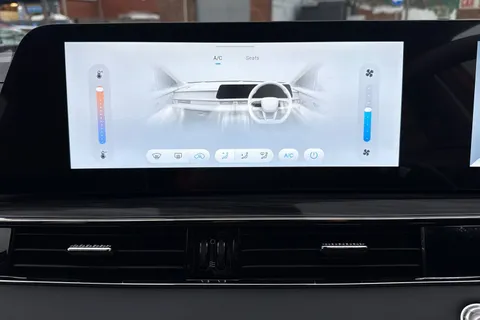

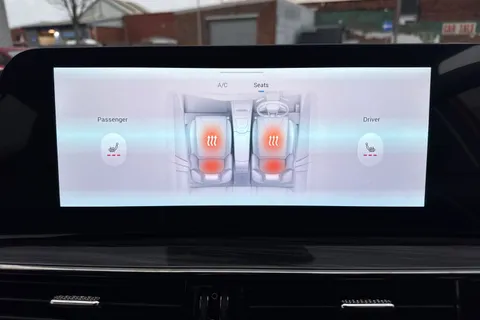

The Omoda 5 was launched in China in August 2022, it carries a bold “Art in Motion” design language and packs strong tech features aimed at younger-minded consumers. The brand claims strong tech orientations with twin large infotainment screens, advanced driver assistance and high European safety ratings, positioning the product as good value but also tech rich.

For Jaecoo, the focus is SUVs and ‘urban'‘ off-road style cars, blending ruggedness with modern tech, signalling a more premium or lifestyle-orientated brand proposition.

Why it matters?

By combining strong technology, bold design, and competitive pricing, these brands are challenging existing assumptions, you no longer need to pay a premium brand to get ‘premium’ features.

Value Proposition & Competitive Landscape

Omoda undercuts established rivals such as the Nissan Qashqai, offering similar size in the mid-sized SUV segment but at a lower starting price. For many customers, particularly value-sensitive buyers, Chinese brands now offer a compelling alternative to European, Japanese or Korean legacy brands. The rapid pace of new model launches and export rollout signals urgency, the newcomers want to scale fast.

Implication:

Legacy automakers can no longer assume geographic or brand immunity. The new entrants bring scale, ambition and aggressive value propositions. For consumers, this means more choice, likely stronger specification.

Challenges & Risks

There are always significant considerations to make:

- Brand Credibility & Heritage - Many customers in Europe or the UK associate legacy brands with reliability, service networks and resale value. New Chinese brands must build trust.

- Perception & Reputation - Some buyers remain cautious about build quality, safety credentials, and brand longevity.

- Competition Intensifies - Legacy players are not sitting idle. They will respond with refreshed models, improved value - meaning the new entrants must keep the pressure up.

What This Means for Global Expectations

Feature Expectations Rise

Value Redefined

Globalisation of Brand Launches

Speed of Iteration

Charging Power Dynamics

Looking Ahead - What to Watch

The things we are looking out for next:

- Will Omoda and Jaecoo achieve scale?

- Local manufacturing and localisation?

- Will there be a mix of powertrains?

- Resale value and brand loyalty?

- Legacy brand response?

Conclusion

The rise of Omoda and Jaecoo is not simply about another Chinese car brand entering the market. It represents a fundamental shift, Chinese manufacturers taking a global view, creating tailored brands for international markets, and offering high-value, tech-rich vehicles that challenge traditional players. For buyers, this is a win. In the UK and Europe, Omoda and Jaecoo are showing that Chinese automotive brands are no longer niche outsiders - they are setting new expectations. As these brands scale and mature, they could well redefine what premium means, where value lies, and how fast the industry moves.