What is PCP car finance?

PCP finance is similar to hire purchase (HP) but instead of your payments being based on the car’s total value, you pay off its depreciation instead (the difference between what the car is worth now and at the end of the contract)

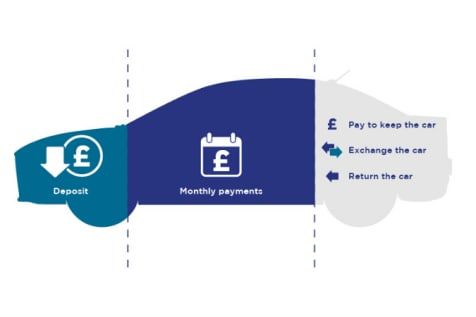

With this option, you can use the car until your contract ends and at the end of the contract, you have three options.

You can either return the car, pay the resale value, and keep it, or you can use the resale value and put it towards buying a new car. These are the only three options available to you at the end of a PCP contract, so you need to have decided what you’re going to do before the contract comes to a close.

You are likely going to be asked to pass a credit check before you will be accepted for a PCP contract. You’ve got to be able to make these repayments every month, and keep in mind that this kind of contract can last up to four years. So, if you don’t think you’re going to be able to keep up with the payments for the entire contract, you might need to consider something else.

There are three simple steps:

1. Your deposit

Your deposit amount will depend on the agreement with your lender. Most ask for around 10% of the vehicle’s value. This goes towards paying off the depreciation, so the more you can pay upfront, the less you will pay each month.

2. Monthly repayments

Your monthly repayments will pay off the car’s depreciation, Bear in mind your monthly cost will also include interest on top.

3. End of contract

At the end of your agreement, you’ll have three choices:

Pay the balloon payment – this means the vehicle will be yours to keep.

Hand the keys back – once you finish paying off your monthly payments, you can return the car to the lender and walk away.

Get a new car – if your car is worth more than expected, you can put that difference – known as equity – towards the deposit of a new car. For example, if your car was expected to be worth £10,000 but it’s actually worth £9,000, you can put the additional £1,000 towards the deposit of your next vehicle.

Can I Get Credit?

Step 1 of 4

Can I get credit

Please answer a few questions, so we can process your finance application.

Estimated time: 1m