What is a credit score?

Your credit score, or rating, is central to a lender deciding:

- If they will consider lending to you

- How much they would be prepared to lend to you

- What interest rate they’ll charge on your loan

What is your credit score based on?

A credit score is based on your historic behaviour; lenders use algorithms, to predict your future financial behaviour from the past data they hold on you.

Put simply, if Cathy lends John £20 and he doesn’t pay it back, the next time John asks to borrow money, Cathy’s going to say no and if Cathy’s shared her experience of John’s behaviour with her friends, then they’re not going to want to lend to him either. That’s a credit score, in a nutshell.

As a new or used car buyer, it's important to understand how your car finance agreement works and how it can affect your credit rating. In this blog post, we'll provide you with the essential information you need to know to avoid any negative consequences on your credit score.

Understanding Your Credit Score

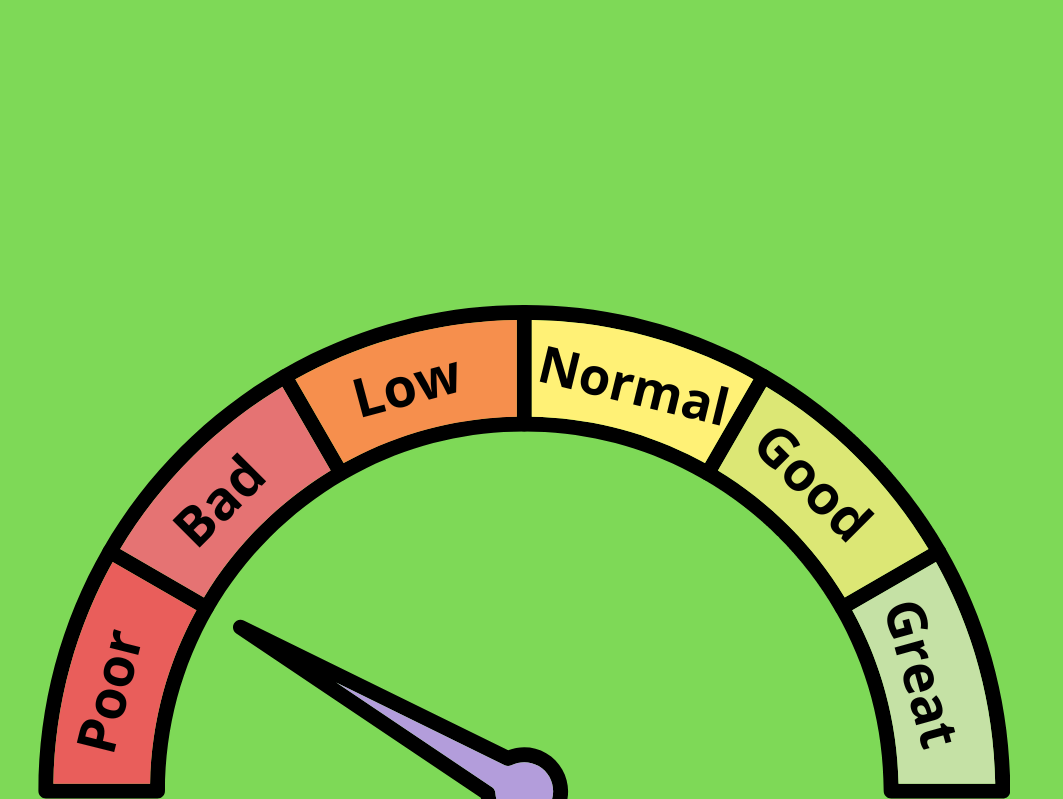

Your credit score is a three-digit number that indicates your creditworthiness. It ranges from 300 to 850, with higher scores being better. When you apply for car finance, your credit score is a critical factor that lenders consider. Before beginning your car search, take the time to check your credit score and ensure that all the information on your credit report is accurate.

Impact of Car Finance on Your Credit Score

When you apply for car finance, the lender will perform a soft credit search to assess your eligibility. If you proceed with the finance option, a hard credit search will be conducted, which will be visible on your credit report. It's important to note that if your application is declined, it may temporarily negatively impact your credit score. However, if you're approved and make your payments on time, your credit rating can actually improve. Demonstrating your ability to manage your finances responsibly can have a positive impact on your credit score.

Improving Your Credit Score with Car Finance

Consistently making your car finance payments, and even making early payments, can have a positive impact on your credit score over time. Early payments demonstrate your commitment to paying off your debt and can help boost your credit rating. Additionally, having different types of credit, such as a car finance agreement, on your credit report can diversify your credit mix and further improve your credit score.

Negative Impact of Missed Payments

Missed or late payments, on the other hand, can be detrimental to your credit score. If you're struggling to make your repayments, it's crucial to reach out to your lender and explain your situation. They may be able to work with you to renegotiate the terms or refinance your car loan. Refinancing could help reduce your monthly payments, making them more manageable. Remember, each missed payment can negatively impact your credit rating which could result in a poor credit score, so it's important to handle your car finance agreement responsibly.

Taking Control of Your Credit Score

Knowing how car finance impacts your credit score is essential for managing your finances and achieving your financial goals. Before purchasing a used car, check your credit score, ensure you can handle the repayments, and make timely payments to improve your credit score. Seeking professional financial advice and considering refinancing can also be beneficial in reducing your monthly payments and safeguarding your credit score. As a car buyer, understanding the implications of car finance on your credit score empowers you to make informed decisions and take control of your financial future.

How can I improve my credit score?

Lenders want to see you’re reliable

The vast majority of us are borrowing money, the most obvious example being a mortgage, but there are so many other contracts we have needing regular payments:

Rent, if you’re a tenant, electricity, gas, water, credit cards, store cards, monthly mobile phone contracts, gym membership and so on and credit agencies want to see that you have a good track record in meeting these obligations on a monthly basis.

Lenders want to see you save!

It may seem a bit back to front, after all you want to borrow money, so why do lenders want to see you saving?

Lenders want to see how much of the money that comes into your account every month, then goes straight out; so if you can manage to save, it goes in your favour. Doing away with one meal out a month or reducing what you spend on luxuries will boost your score.

If that small sacrifice means you’re lent a larger amount, perhaps at a cheaper rate of interest, it could make a significant difference and be well worth the sacrifice.

Lenders want to be sure where you live

Lenders check the electoral roll to check that you are registered as living at where you say you live, so, if you’re not registered to vote, you’ll have difficulty proving where you live and how long you’ve lived there.

Make sure that you register to vote as soon as you move into a new address, not doing this will mean that many lenders will simply not consider you as creditworthy.

The Credit score hat trick

- Reliability – making monthly payments for utilities, phones etc, on time.

- Living within your means – Not spending more than you earn and saving a little.

- Stability – in terms of how long you’ve lived at your address.

It’s easy to check your credit rating online and you should make sure the details are correct and up to date. The main agencies are Experian and Equifax and remember you don’t need to sign up to a monthly plan to get your credit report, it is yours by right and you should be charged no more than £2 to receive a copy.